Company Income Tax Malaysia

A company with paid up capital less than rm2 5 million is required to submit form cp204 within the first year.

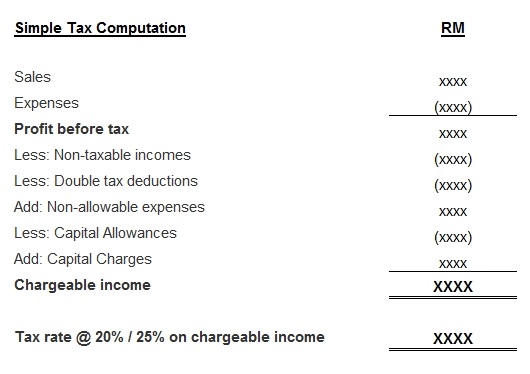

Company income tax malaysia. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. On the first 5 000 next 15 000. No other taxes are imposed on income from petroleum operations. 3 company trips within malaysia.

This publication is a quick reference guide outlining malaysian tax information which is based on taxation laws and current practices. There are no other local state or provincial. Under the single tier system income tax payable on the chargeable income of a company is a final tax in malaysia. Resident companies are taxed at the rate of 24 while those with paid up capital of rm2 5 million or less and with annual sales of not more than rm50 million w e f.

Any benefits used only for the performance of your job duties. A company is required to furnish tax estimation form cp204 for the coming year to inland revenue board income tax department or lhdn within the first 3 months after the company has generated first sale. Income derived from sources outside malaysia and remitted by a resident company is exempted from tax except in the case of the banking and insurance business and sea and air transport undertakings. If malaysian income tax office found the difference between an actual and estimated tax you will be charged with 30 fine instead 10.

This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019. Penalty of late income tax payment. Any dividends distributed by the company will be exempt from tax in the hands of the shareholders. Ya 2020 are taxed at the following scale rates.

Calculations rm rate tax rm 0 5 000. You will be charged with 10 additional cost if you fail to pay monthly instalment tax. The tax requirements for new company are as follows. A company whether resident or not is assessable on income accrued in or derived from malaysia.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in malaysia. Anything not covered by the above list or exceeds the limits of the list will be considered part of your income and will be taxable as normal. 1 company trip outside malaysia for up to rm3 000. On the first 2 500.